ALIVE

This article was originally written in August 2020.

The full impact of COVID may be felt for many years to come and will doubtless have an enormous impact on the financial services industry and client relationships. With changes in consumer preferences and behaviours predicted by many to outlast the crisis, how financial brands adapt their marketing and communications strategies in the next era will be crucial to both their immediate and their long-term success.

With almost one in four UK HNW’s having already made changes to their financial, investment and business strategies*, it’s no surprise that now, more than ever, clients need leadership, inspiration and innovation from brands. Brands that they can trust to guide them through the crisis, that can demonstrate the right values and provide valuable reassurance. For many brands the coronavirus epidemic is forcing them to either discover their purpose or back up their purposeful words with action.

And the world is watching. The transformative shift to “business-as-unusual” has resulted in a deluge of value-led brand messaging like never before. From supermarkets to dating-apps, most brands have been desperate to communicate something – anything - to consumers about their stance during the pandemic. In many instances it wasn’t long before the recipients found these reassurances to be a “running joke”.

Consumers are adept at recognising empty words and gestures, no matter how well-intentioned. The challenge is to deliver this reassurance and brand leadership in an intelligent, considered way that truly resonates with consumers and feels inherently aligned to a brand and its values.

To help financial brands both navigate and thrive through these unheralded times, we’ve developed A.L.I.V.E

a strategic marketing model for the post-COVID era. Built around five tenets of Assurance, Leadership, Innovation, Values and (Customer) Experience, ALIVE is designed to offer a platform for marketing and communication re-evaluation and, in some instances, wider brand and cultural transformation.

ASSURANCE

Wealth Managers, Private Banks and Asset Managers have had to play a key role in helping clients make sense of what the crisis means for their investments. But, unlike the volatility of previous market falls where wealth and asset managers can use historical records to reassure clients that markets will bounce back, this crisis is witnessing enormous change to entire business categories that could take decades to recover. In addition, investors are seeing a £32bn reduction in dividends that will chip away at a substantial source of their income. It therefore comes as no surprise to see many investors shifting their money to “safehaven” investments or exiting the stock market altogether. There is also an increase in switching as clients seek lower fees or express dissatisfaction with wealth managers or private banks that have not responded well to clients concerns during the crisis.

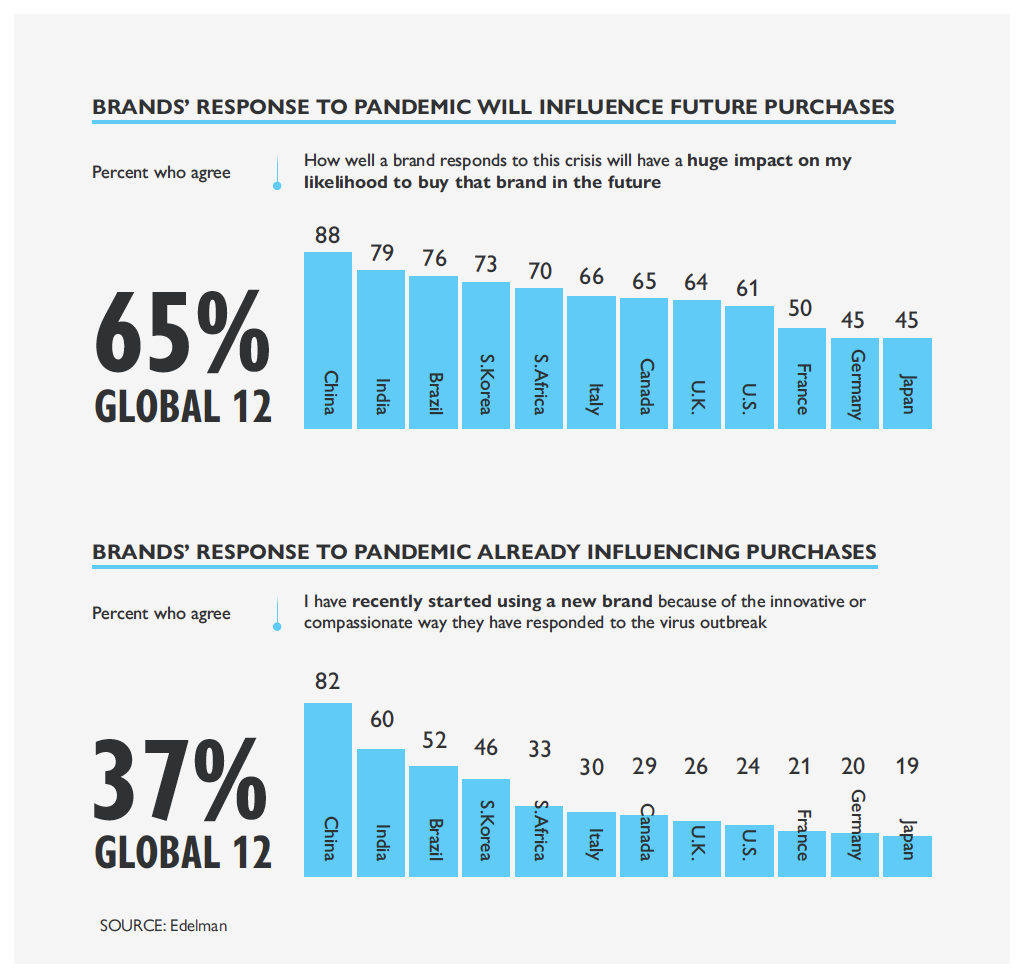

Financial brands need to be transparent with customers and give them as much control as possible. It is no coincidence that the businesses that have been seen to have responded well by reassuring customers during the pandemic, that have demonstrated empathy and put customers front and centre, are those that are statistically far more likely to both retain their existing clients and win new ones.

LEADERSHIP

As the world emerges from this period of disruption, the Wealth Management and Investment industry has a critical role to play in redefining what financial wellness means for people in the post-COVID era. As a society and a category there are undeniable links between wealth and health, and there is a new focused need for financial preparedness that ensures citizens across the world can withstand a prolonged disruption to income or seeing their wealth eroded. Banks, Investment Houses and Wealth Managers can all play a role in engaging with their clients as trusted and empathetic providers of financial advice and goals-based planning to help individuals make the necessary adjustments to achieve financial wellbeing.

SOURCE: Canvas8 March 2020

SOURCE: Canvas8 March 2020

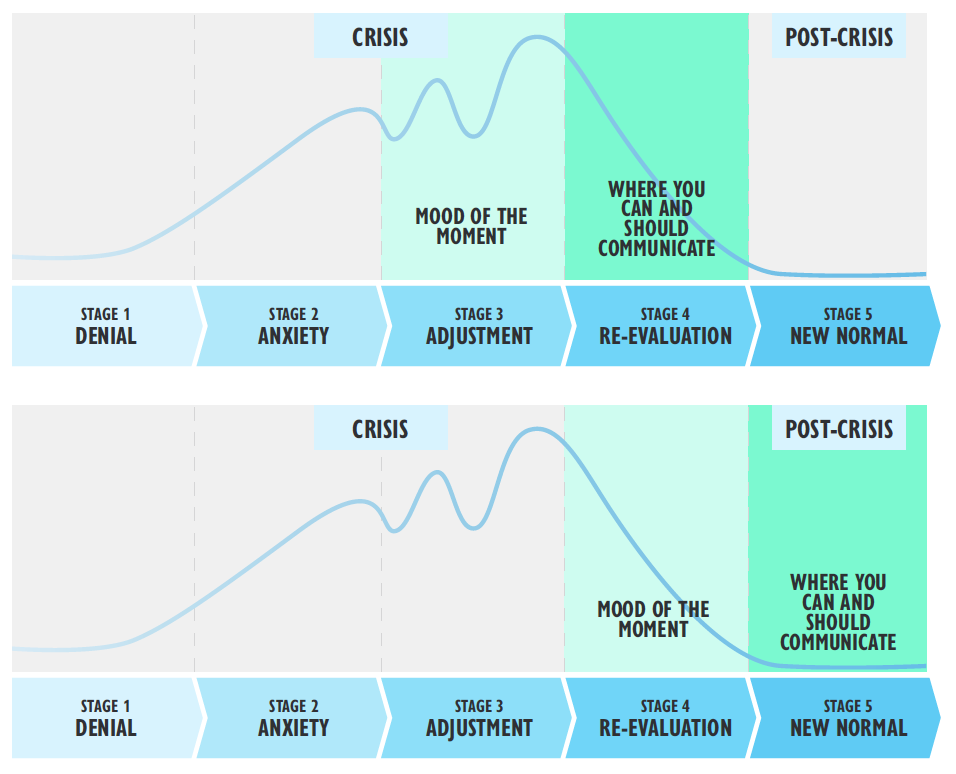

It is equally important that brands demonstrate real leadership and inspiration, not by reflecting on what has happened, but by anticipating and staying one step ahead of competitors and consumer sentiment.

INNOVATION

Hopes, dreams and ambitions have only been dampened by COVID-19. Suppressed perhaps but not destroyed. Many, most in fact, are like coiled springs waiting to bounce back. It’s one of the fascinating features of the time we live in that there has been a surge in new account openings especially on automated platforms, as new investors seek to capitalise on the market volatility. Equally, digitalisation will accelerate. Movement towards truly digital services amongst investment firms and wealth managers has been slow, especially in comparison to retail banking. Yet digital delivery has become a necessity and adoption, even amongst the most “digitally resistant” clients, has grown strongly over the past few months. China-based Ping An Bank rolled out a new “Do-it-at-home” functionality and received more than eight million page views and nearly twelve million transactions within two weeks. Another financial brand that launched a series of online shows featuring leading investment managers sharing market insights and discussing the impact of COVID-19 has seen significant client engagement.

Under lockdown digital has become the primary channel for financial businesses and, combined with the rising influence of disruptive technologies on investment, we are witnessing the antithesis of private banking and traditional wealth management – the diminishing role of human interaction. This means brands need to prioritise the quality and capacity of remote channels and the development of new ones. The answer for these businesses is to find a way to adopt digitisation without losing the human touch. Known in some quarters as Phygital, financial brands can learn from the digitalisation of other sectors where there is a growing focus on immersive technology innovations related to voice as a channel, augmented reality, hyperpersonalisation, gamification, social-virtual reality, secure video interactions and AI-powered chatbots.

“WE ARE WITNESSING THE ANTITHESIS OF PRIVATE BANKING AND TRADITIONAL WEALTH MANAGEMENT – THE DIMINISHING ROLE OF HUMAN INTERACTION”

VALUES

It’s too early to be certain, but indications are that investors’ values will make a quantum shift to a more sustainable, accountable and fairer future. Over the past three months, while net outflows across all European-based funds stood at $148bn, investment in ESG funds actually grew by $30bn and may now be fully coming of age. In the US, some asset management firms have come under intense fire for claiming furlough payments when the markets have largely recovered from the initial crash. Studies repeatedly demonstrate that the brands that are seen to behave responsibly, and that can embrace or lead this shift in values, are statistically far more likely to be the brands that consumers choose going forward.

But before pivoting their brand strategies in the wake of COVID-19, companies should reflect on their brand values. What they can offer that others can’t, how they can be relevant, authentic and useful and how those values translate into propositions that will both meaningfully differentiate them from their competitors and provide a platform for effective marketing, messaging and customer engagement.

“BEFORE PIVOTING THEIR BRAND STRATEGIES IN THE WAKE OF COVID-19, COMPANIES SHOULD REFLECT ON THEIR BRAND VALUES.”

EXPERIENCE

Investors are naturally anxious when markets are volatile and the future is as opaque as it’s probably ever been. It’s in these periods of significant uncertainty that Private Banks, Wealth Management and Asset Management firms have the greatest opportunity to strengthen their brands by delivering a world class customer experience. Now, more than ever, clients need additional information, guidance and support to help them navigate uncertainty. Keeping a real-time pulse on changing client preferences will also be key to successful engagement. Traditional customer insight techniques have a long time lag and in this new world can be too slow to deliver a valuable perspective. The surge in online usage offers brands an opportunity to tap into insights from social media, to understand sentiment and to develop new ideas or adapt messaging.

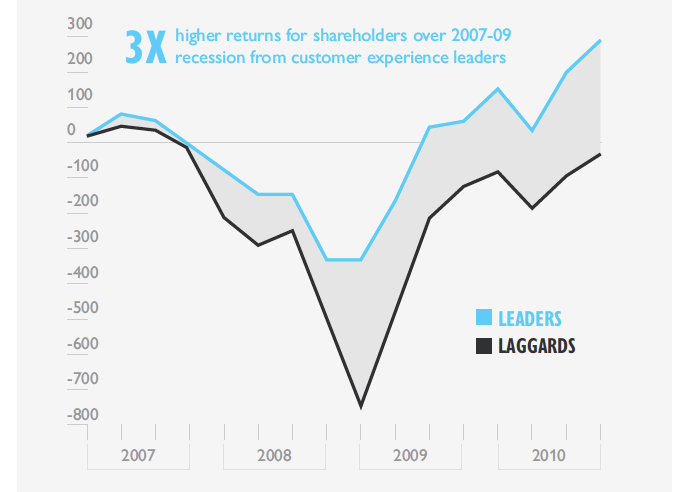

FOCUSING ON CUSTOMER EXPERIENCE IS A WINNING STRATEGY IN RECESSION.

Total returns to shareholders of customer experience leaders and laggards, *% by quarter.

*Comparison of total returns to shareholders for publicly traded companies ranking in the top 10 or bottom of Forrester’s Customer Experience Performance Index in 2007-09. SOURCE: Forrester Customer Experience Performance Index (2007-09); press search

Equally, client communication needs to be highly personalised and relevant to present clients with a unique value proposition. The Wealth & Asset Management sectors, in particular, have been slow to recognise the increasing diversity of affluent and HNW audiences and adapt their marketing accordingly, relying on a one-size-fits-all approach. Brands like Investec have made huge strides in recognising this and building sophisticated audience segmentation models, developing bespoke content for audiences like HNW women and creating a goals-based marketing model that taps into the emotional drivers of clients, not simply rational service-based messaging. In a world where younger, affluent audiences in particular are far less likely to be influenced by big established names, developing a memorable and unique customer experience is the most likely way to generate word-of-mouth recommendations.

THE MARKET OPPORTUNITY

COVID-19 presents a significant opportunity for Wealth Managers, Asset Managers and Private Banks to reach underserved investors and those not satisfied with the advice and service they are currently receiving. In recent research by Bain & Co the study found that of 1200 HNW investors with up to $5million in investable assets, roughly half were not receiving any advice and of those that were, 50% were not fully satisfied with the advice they receive. To tap into this opportunity some firms have already ramped up their marketing using innovations like virtual ‘happy hours’ to connect with influencers such as Estate Planners, Accountants and Lawyers, as well as offering free wealth planning advice to secure new assets under management.

HOW BBD PERFECT STORM CAN HELP YOUR BRAND SUCCEED IN THE NEW NORMAL

- Identify your brand purpose and transform your marketing approach.

- Develop an in-depth client Affluent/HNW audience segmentation based on quantitative and qualitative research to inform your client targeting strategy, identify market opportunity and inform your marketing programmes.

- Benchmark your firm against industry leaders and innovators and develop a differentiating market positioning.

- Develop robust user journeys across digital channels to optimise client and prospect engagement.

- Model, analyse and enhance your end-to-end customer journey and client experience from acquisition through to onboarding and in-life communications.

- Design and build market-leading digital platforms and support on social media engagement.

- Support you in developing and delivering an engaging multi-channel content marketing strategy.

- Strengthen your competitive advantage across critical client experience touchpoints.

- Build a client advocacy programme.

- Leverage cognitive diversity in the development of internal communications programmes to improve customer experience and drive cultural change.